Find out how much you’ll need to bring up a baby to adulthood. Plus, practical tips on growing your money!

It’s a fact — raising a family in Singapore isn’t cheap. After all, we are considered the ninth most expensive country in Asia and the 20th most expensive in the world by research company ECA International.

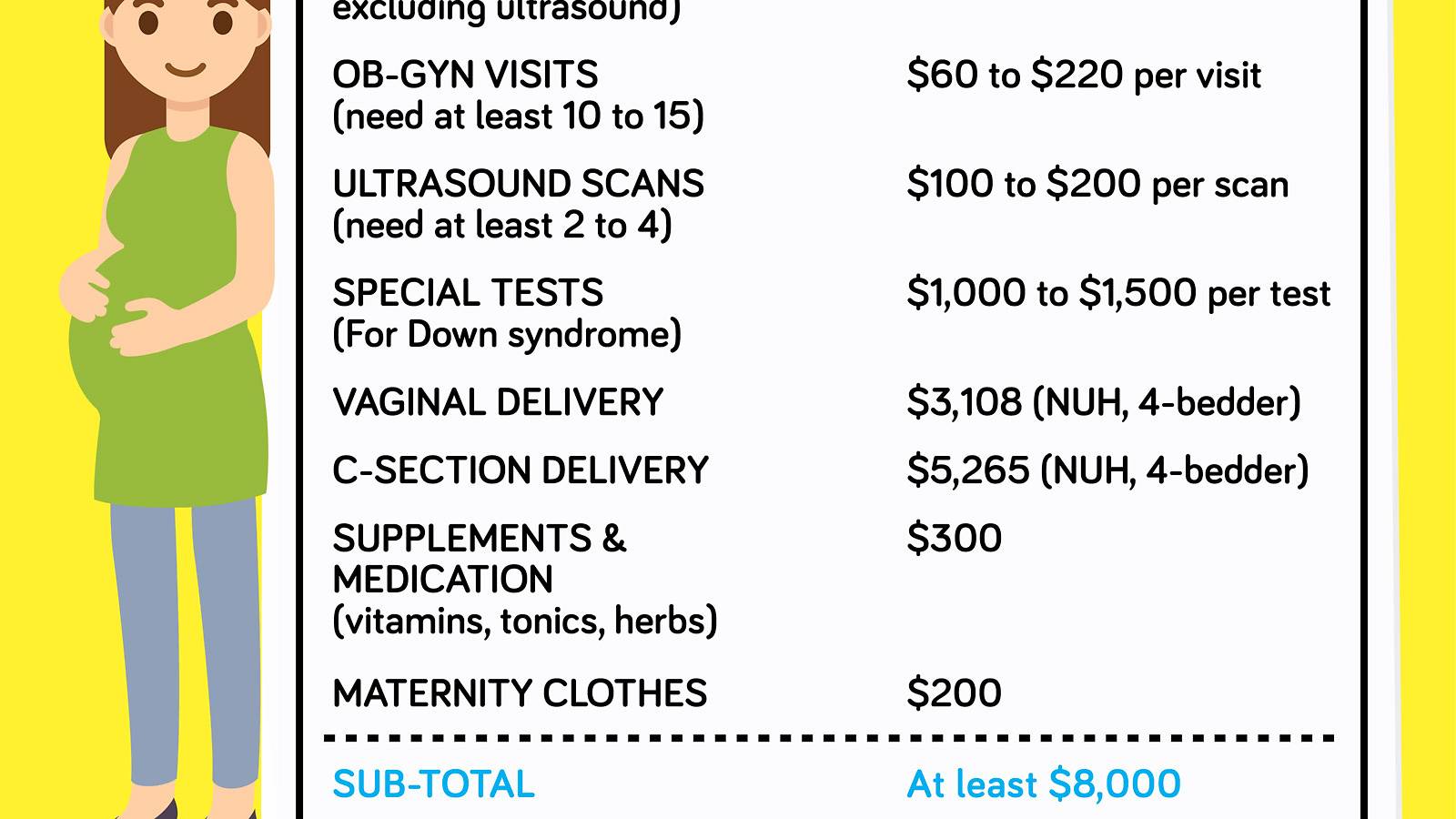

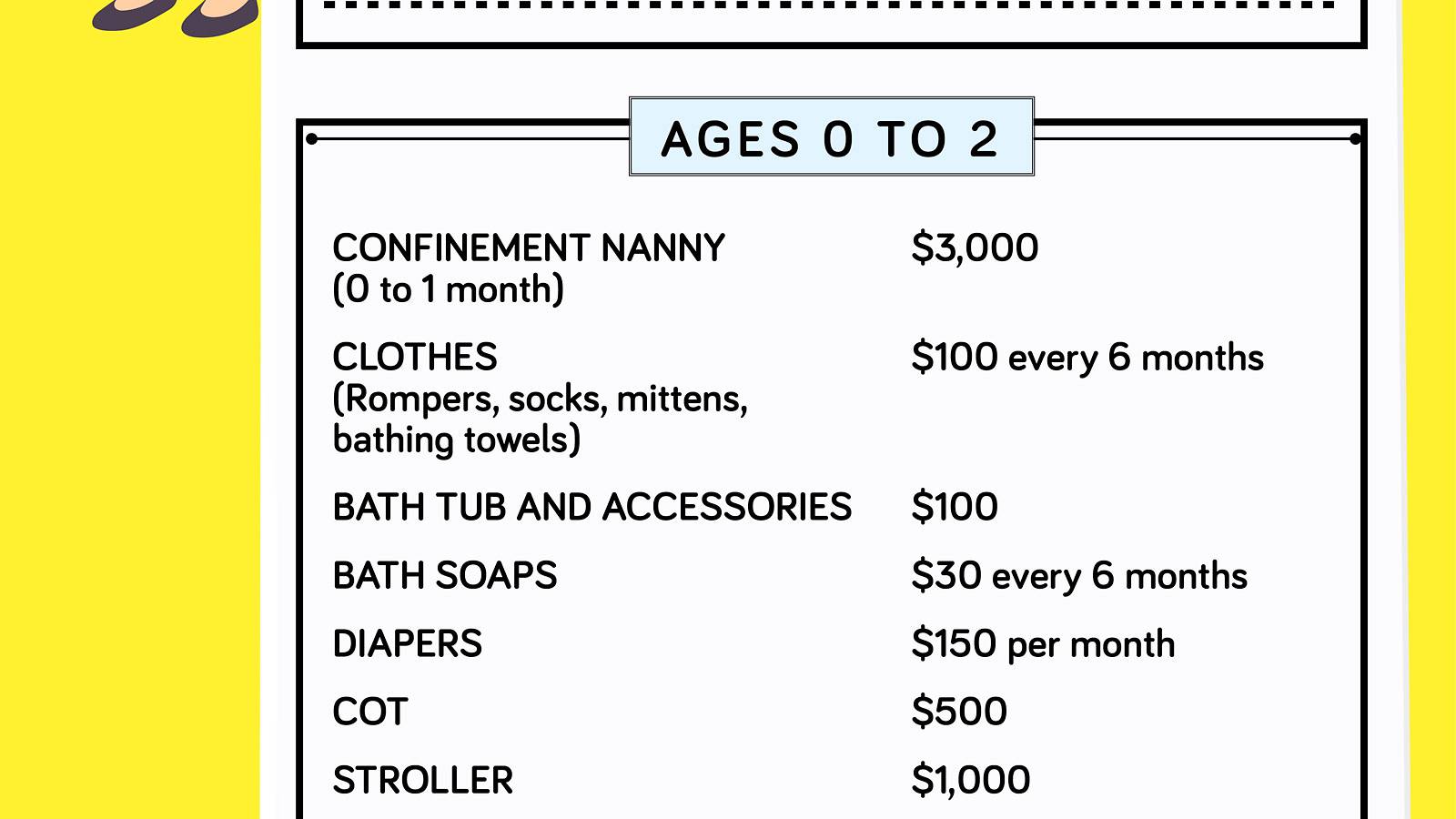

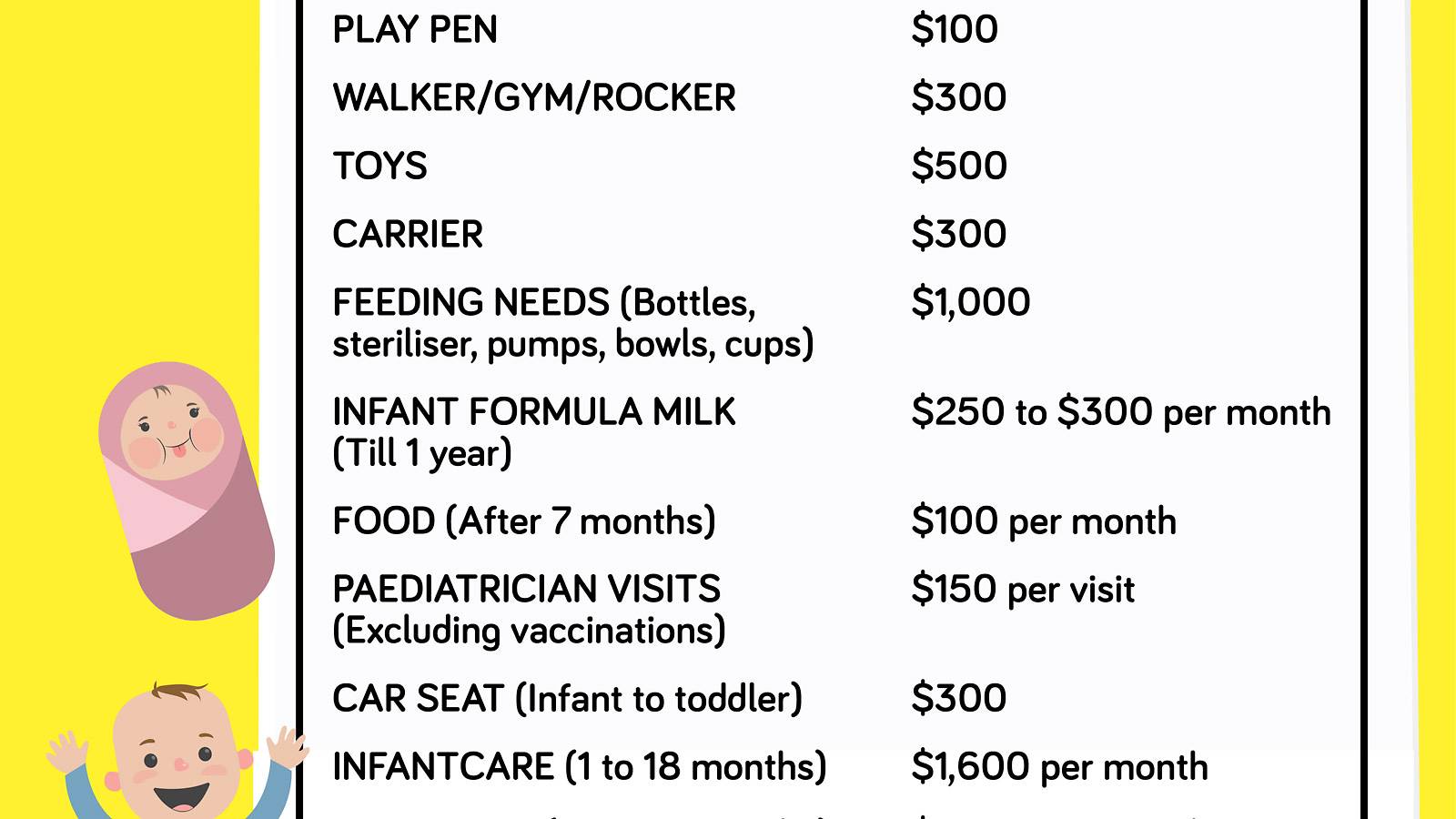

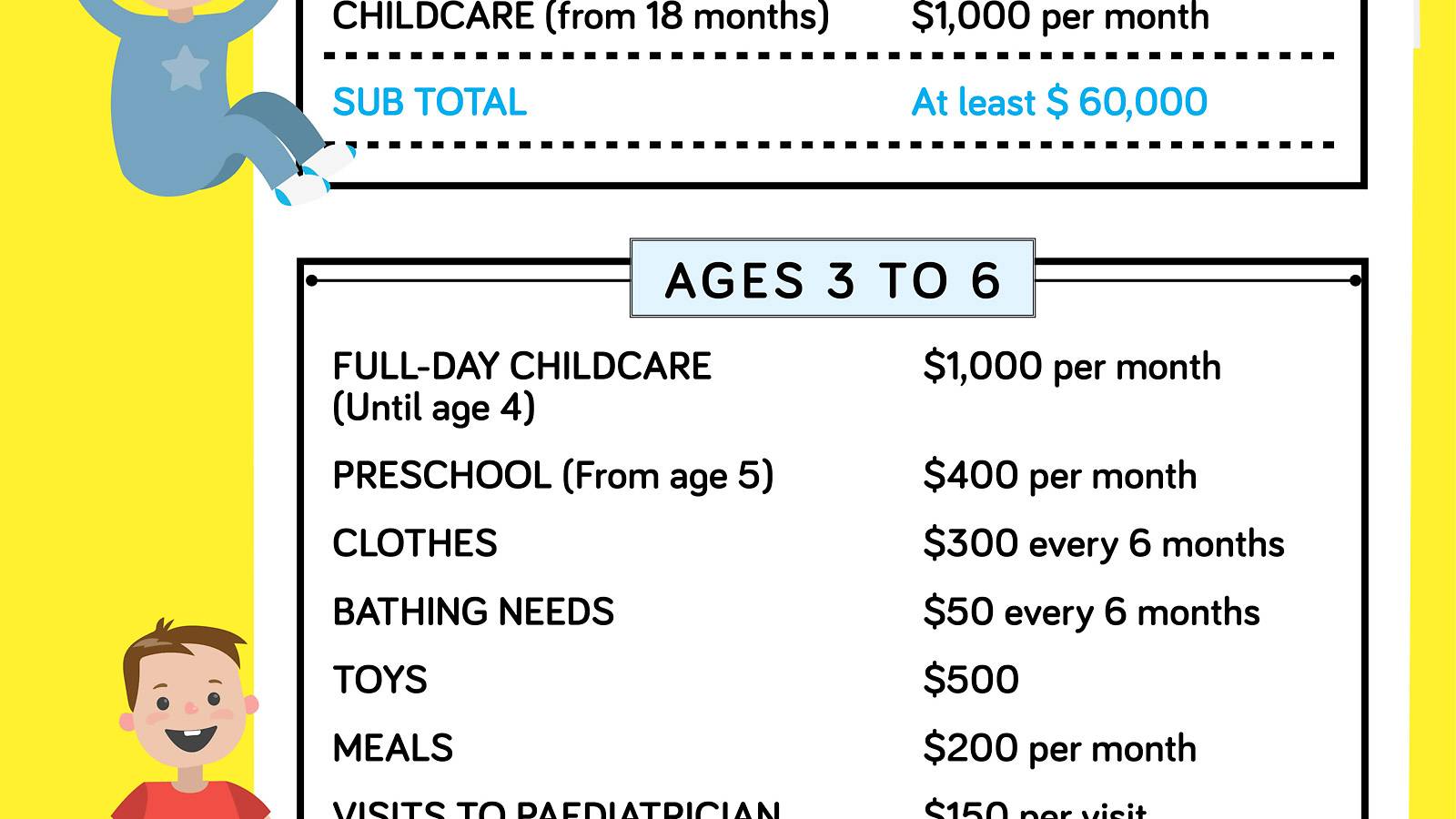

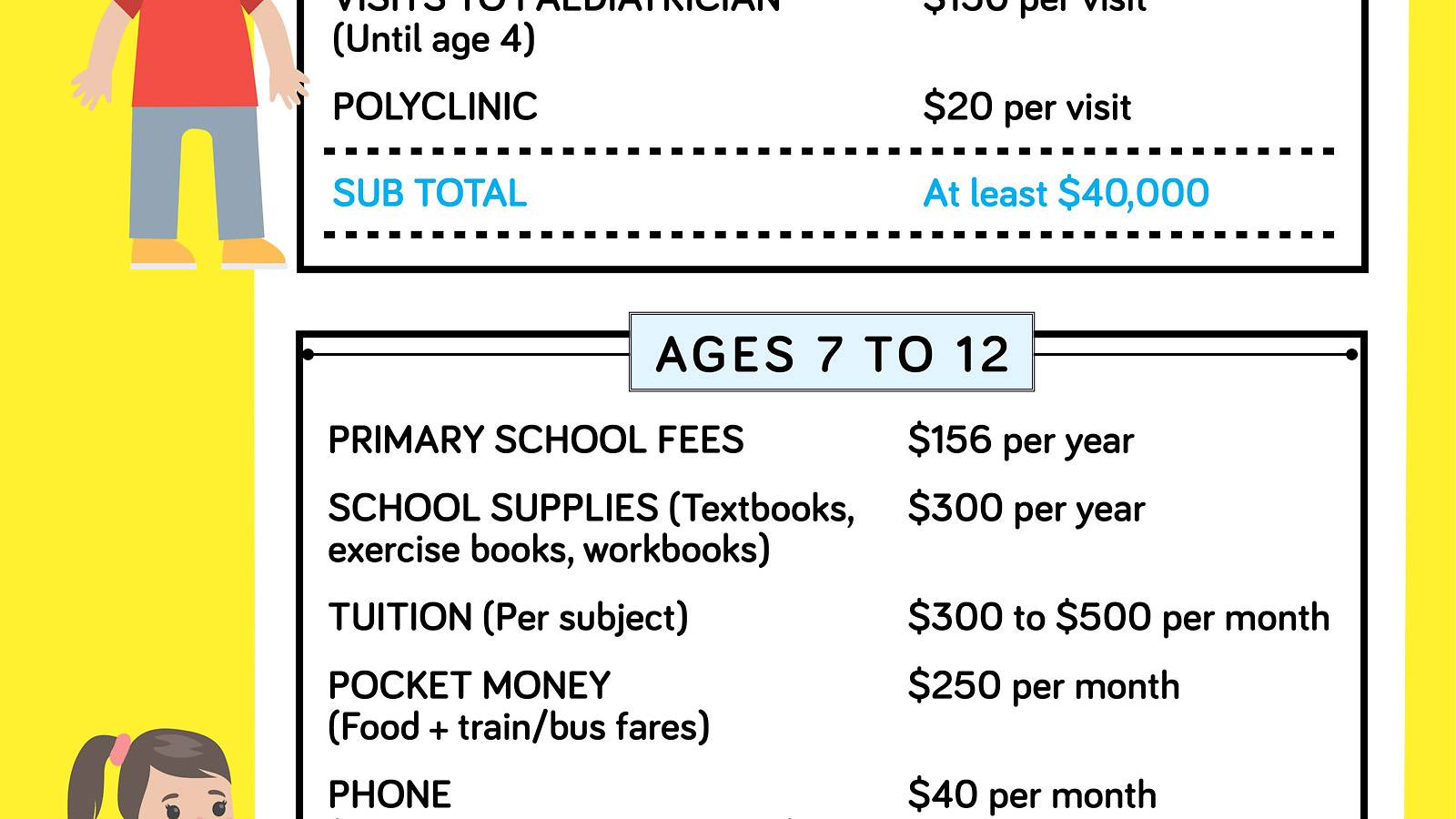

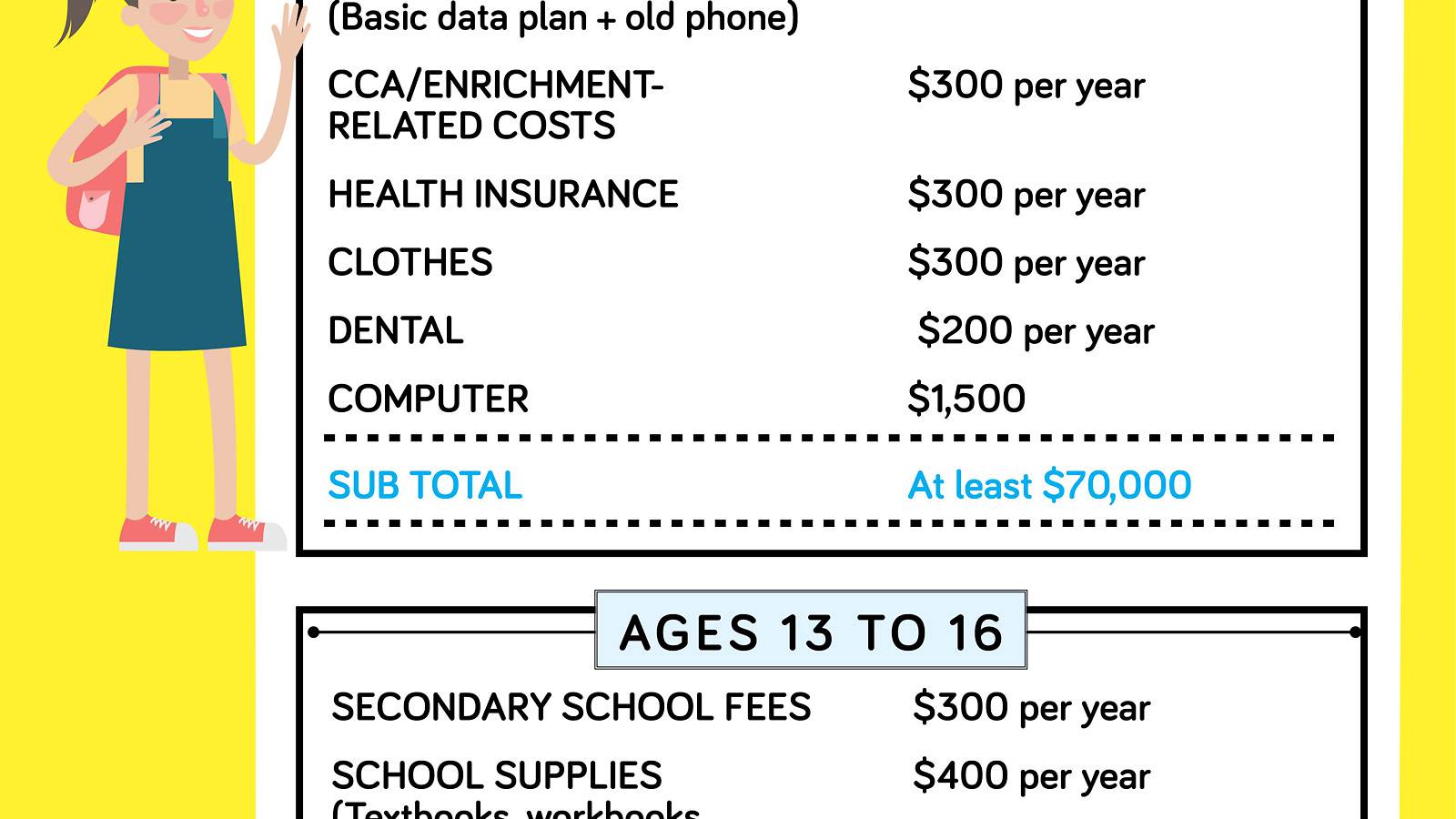

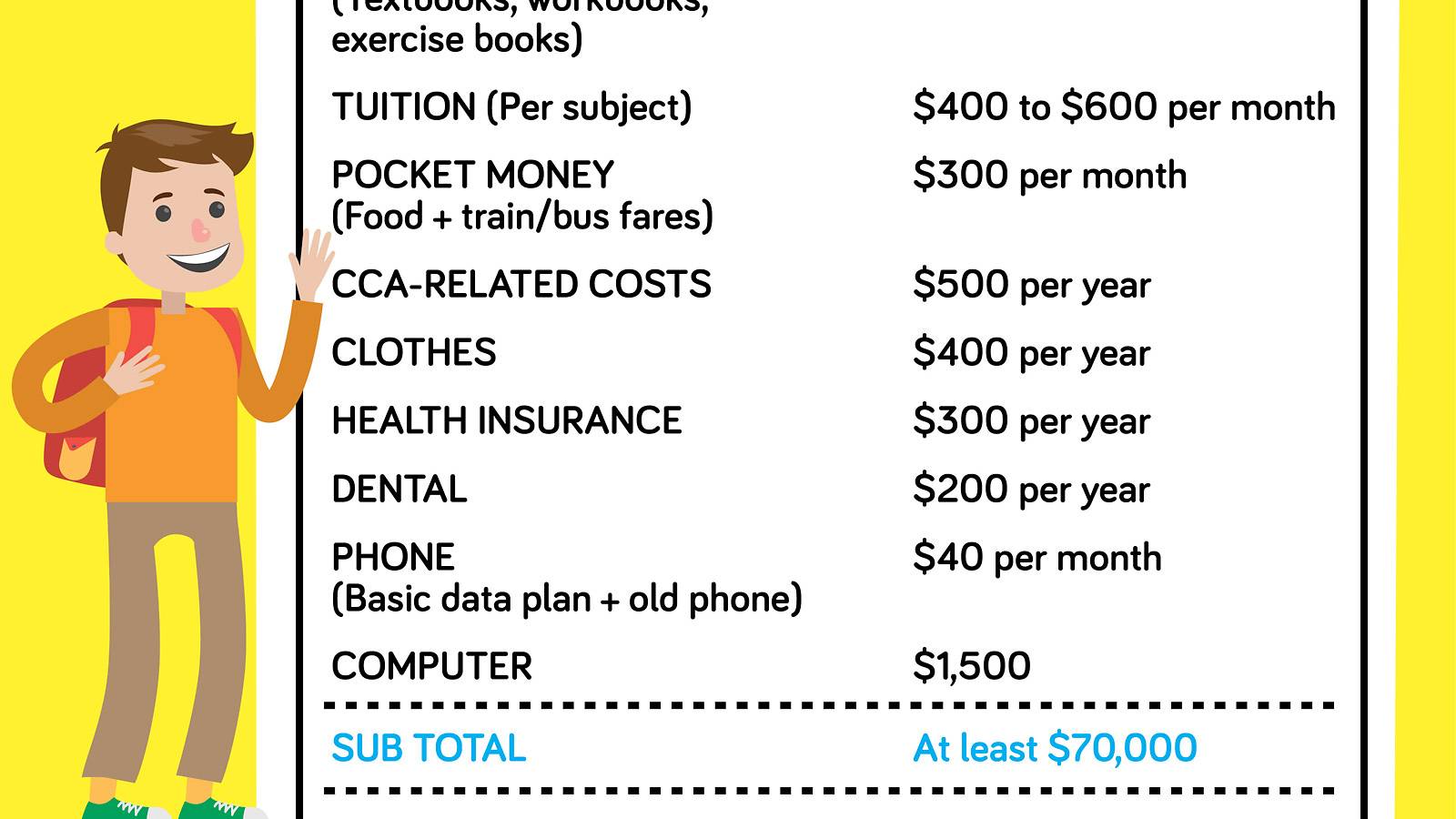

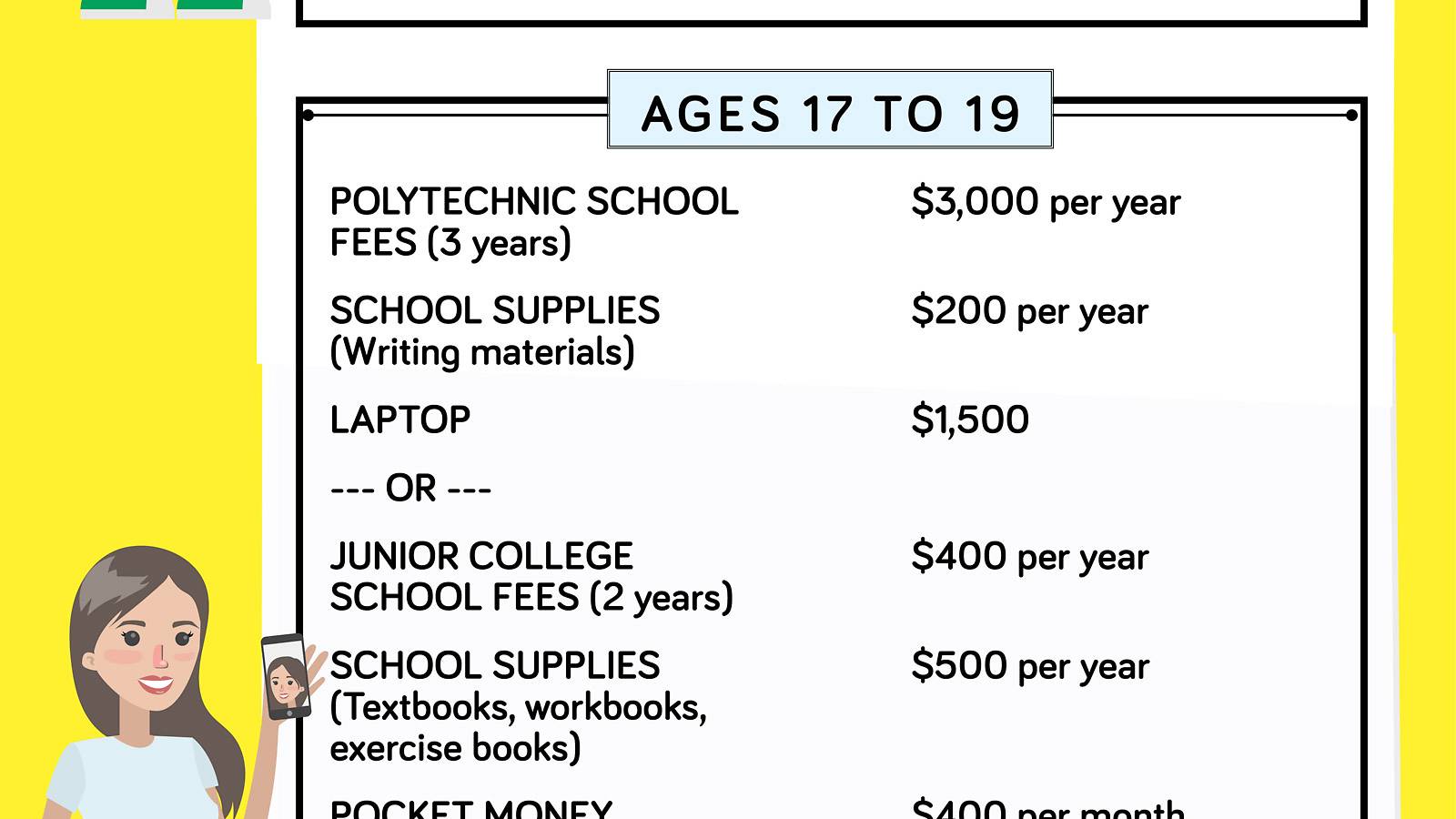

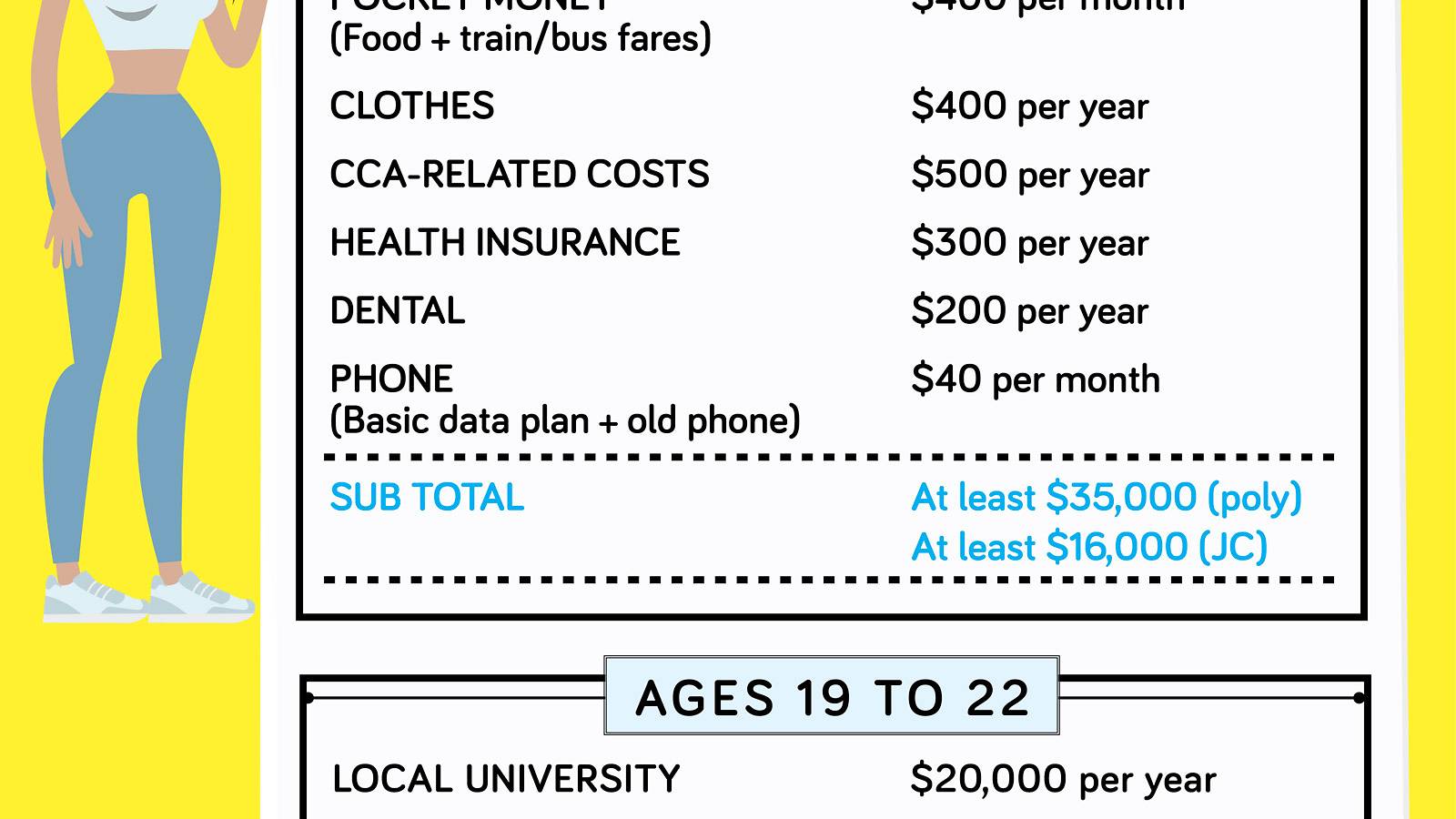

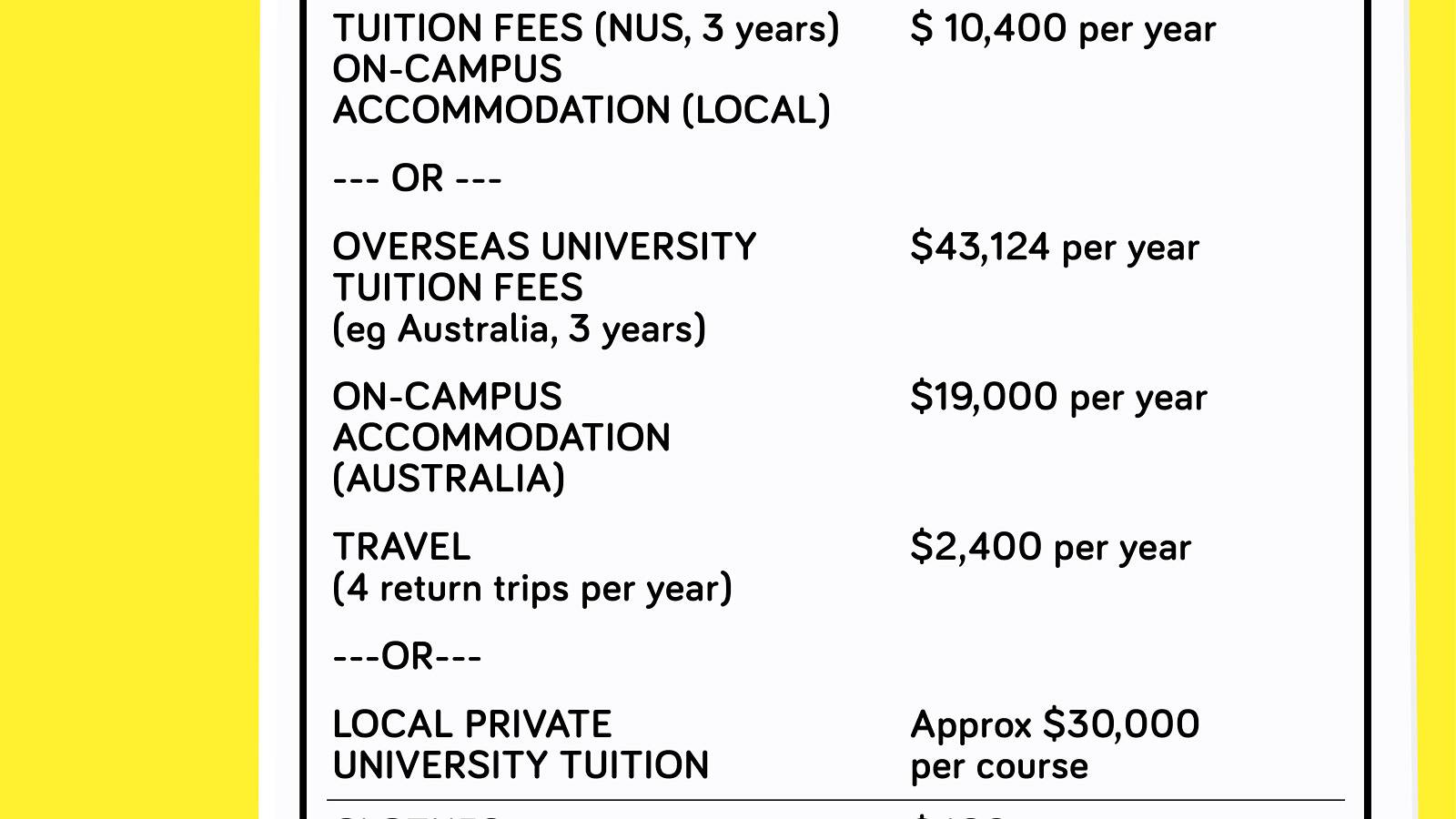

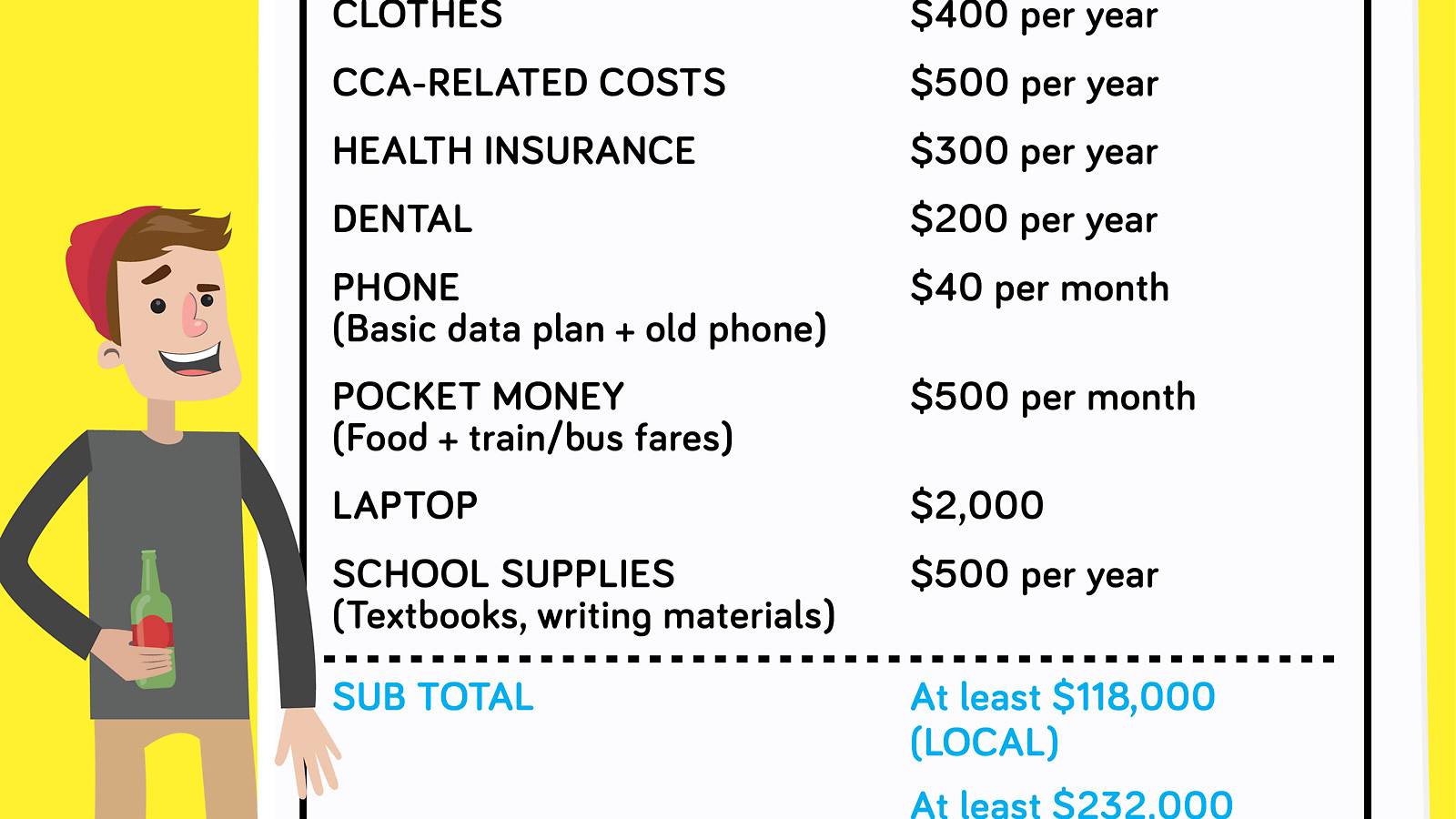

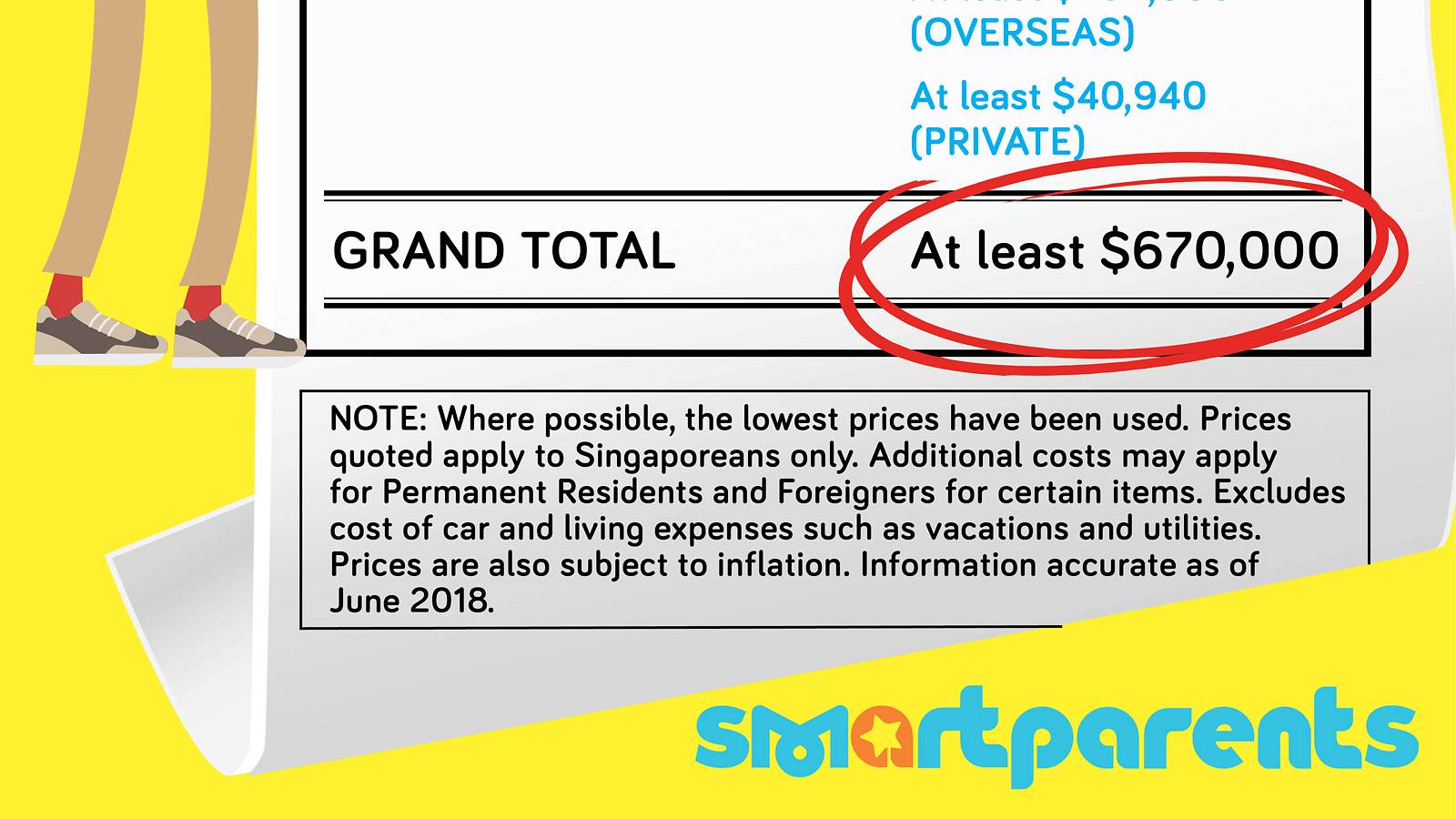

But just how much money will you need to provide for your child from birth to young adulthood? SmartParents approached a financial planner with AXA Insurance, Kang XueMing, to crunch the numbers.

The result? You’ll need to save up more more than half a million dollars! We’ve rounded up the figures for you…

Infographic: Rachel Lim

Save more with our simple strategies

The price tag for raising kids seems astronomical when compared to your monthly salary. But with a good savings plan in place, you will be able to meet most of the financial costs involved.

So, if you don’t already have a savings plan in place, approach your bank to set one up or start saving on your own, Kang says. It can be as simple as setting aside a small portion — between five and 10 per cent — of your monthly salary at the start of every month in a different bank account. And make it a rule that the money can only be deposited into the account, not withdrawn.

Whether you have built up a decent nest egg or not, you can still research ways to make investments from the many that are available that suit your financial ability. Besides buying stocks or investing in property, which may require quite a lot of money, you can also consider making other longer-term investments.

Kang points out, “These are managed by a team of professionals and are called investment-linked policies, unit trusts or exchange-traded funds.”

If you aren’t sure how to make investment decisions, speak to a professional financial planner, he advises. You should also encourage your spouse to chip in, so that you’ll both be able to save more money for the family.

Remember to always do your research to see if you qualify for any additional government subsidies and rebates for things like income tax, utilities, or any of your childcare expenses. Kang offers more tips:

* Try rental services or using hand-me-downs from a relative instead of buying new baby care necessities or equipment immediately. These rental services offer necessities like prams, cribs, breast pumps to even high chairs. What’s more, this gives you an opportunity to try out the item before making a purchase or swapping it for another brand.

* Save on your child’s tuition or enrichment lessons by enrolling them in group classes instead of one-on-one lessons. Your child will make more friends in the process.

* When your child bugs you for a new gadget or smartphone, you need to examine if they have the maturity and responsibility to mind their belongings and if they really need to own one.

* If you do give your child a smartphone, never start them off with a new or the latest phone model as they probably don’t need the functions that come with it. A hand-me-down doesn’t just help you save money, your kiddo won’t become a prime target for pickpockets.

* Do also stick to a basic phone plan and refrain from adding unnecessary amounts of data. This will help to also curb their phone usage as well.

* Look out for discounts and promotions at places of interest such as the Zoo, Bird Park, Science Centre and theme parks especially during holiday season.

Main photo: iStock

Like us on Facebook and check SmartParents regularly for the latest reads!

Elsewhere on SmartParents.sg…

4 ways to bring up a tech-savvy tot