Couples can tap on various grants and schemes when purchasing their first resale flat

Housing is one of the hot topics of the newly engaged and newlyweds. Having a home isn’t just a significant step forward you’ll take as a couple, it’ll be one of the biggest investments you’ll ever make. If it is your first time buying a new flat from HDB, you may receive up to $80,000 in housing grants on top of the significant market discount. 17,000 BTO flats will be launched in 2017. HDB will also launch some BTO flats with shorter waiting time of about 2.5 years (from 3 to 4 years previously), starting with about 1,000 units to be launched in 2018.

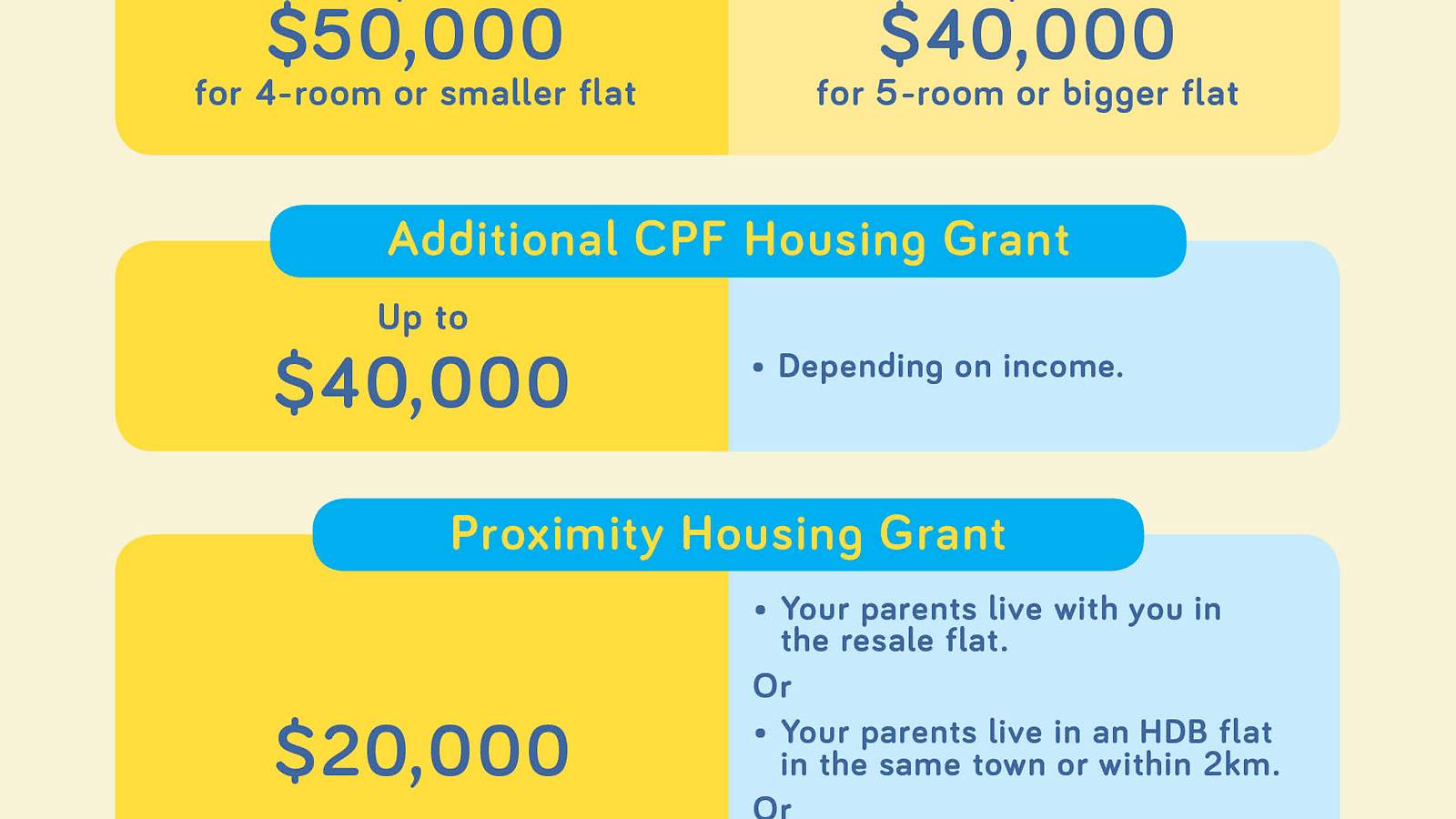

For those who prefer to move in quickly and have specific preferences on location, they may wish to buy a resale flat. The good news is that if it is your first time buying a resale flat, you can receive up to $110,000 in subsidies through the newly enhanced CPF Housing Grant, additional CPF Housing Grant and the Proximity Housing Grant.

If you have set your eyes on a resale flat, whether because of its convenient location, proximity to family, its existing décor or distinctive character, there are some schemes that can help offset the costs of buying one.

Details on buying a resale flat, plus the financial subsidies you’ll be eligible for…

Infographics: Rachel Lim

Main photo: iStock

This article is in collaboration with HeyBaby

You may also like…

Buying a new or resale HDB flat? Here's what to know...