Booked your family getaway? Don’t forget to buy travel insurance! Here are the best ones on the market.

Of all the holiday seasons, many of us look forward to the December break the most. Not only does it coincide with all the Christmas festivities, it’s the longest school break, so it’s a great time for parents to plan a good vacation.

Now that you’ve shortlisted your vacation hotspots, done your research and decided on the ideal location, it’s time to think about a good travel insurance policy.

We know what you’re thinking: Most travel insurance policies offer similar benefits, so why not just pick any one? But this is actually a common misconception. Premiums shouldn’t be your only consideration when it comes to choosing your travel insurance.

You should keep an eye out for other things, such as a travel inconvenience cover ― in the case of travel delays ― as well as overseas medical expenses and medical repatriation [necessary evacuation to a medical facility] benefits.

You should focus on these three policy aspects as travel inconvenience and overseas medical expenses could happen during a holiday, especially when you have kids. Also, medical repatriation can be very expensive if you don’t have insurance.

So, don’t just consider the insurance premium, look at what you’re covered for. This can vary from policy to policy. For example, certain travel insurance policies will offer unlimited cover for medical repatriation while others may have a limit for up $1 million.

How to decide on a policy

It goes without saying that if you’re travelling as a family, you should get a family policy. Family policies usually cover two adults and two children, instead of individual plans for each member.

Your travel inconvenience cover will offer compensation for loss or damage of every item and for the number of hours that you are stranded at the airport.

Say, you plan to take a 10-day family vacation in the UK in December ― what are the major concerns you need your insurance policy to cover? Here are a few possible scenarios: Your baggage could get lost in transit or your precious items ― such as your laptop, mobile or jewellery ― could get damaged. You might also be stranded at the airport if your baggage doesn’t arrive on time. Your travel inconvenience cover will offer compensation for loss or damage of every item and for the number of hours that you are stranded at the airport.

The food in the country might not sit well with your child, or they might fall sick from a change in weather temperature. As a foreigner, medical expenses is likely to cost a bomb. So, look at medical expenses and medical evacuation limits and what each of them cover.

And if you have to cancel your trip at the last minute, buying travel insurance will ensure you don’t lose all the money you’ve already spent on flight tickets. A good insurance policy will refund all the money, including the non-refundable portion, under the trip cancellation benefit.

Is credit card travel insurance enough?

Leading banks in Singapore offer complimentary travel insurance on their credit cards when you use them to purchase your round-trip travel tickets. If you think that might enough for you and your family, know that credit card travel insurance largely covers personal accident and travel inconvenience only.

Also, while the insurance cover could be up to $1 million if you charge all your airfare to your card, the travel insurance is based on a one-suite-fits-all concept. You will have no wiggle room to customise it.

If you’re going on a short trip, credit card travel insurance might suffice. But for a long-haul trip, you should get a comprehensive cover. By the way, credit card travel insurance doesn’t cover all insured members equally. The maximum cover is given to the principal cardholder. In other words, ancillary insurance benefits, such as travel inconvenience cover, may not extend to family members, including your kids.

Policies that cover family travel

Here are family travel insurance policies and their unique features to consider…

Policy #1 NTUC Income Travel Insurance

Standout features Offers family cover to an unlimited number of children. This will be particularly useful if you have more than two kids, because most family plans in Singapore apply to only two kids. Another unique aspect of this protection is that you it covers pre-existing medical conditions and also, if you sustain any losses because of that while you’re overseas.

Policy #2 DBS TravellerShield

Standout features This is perfect if you’re taking a trip where you and kiddos plan to be do extreme sports as this insurance covers extends to activities such as skiing, snowboarding, bungee jumping, skydiving, paragliding, helicopter rides, jet skiing, mountaineering, hot air ballooning and more. This cover is available in both the Premier and Platinum plans.

If you have to cancel your trip at the last minute, buying travel insurance will ensure you don’t lose all the money you’ve already spent on flight tickets.

Policy #3 OCBC Explorer

Standout features Offers a variety of add-on covers to your existing travel insurance plan that can turn your basic plan into a more comprehensive one. For an additional charge, you can extend your cover to any sports equipment that you might be carrying, such as golf clubs and snowboarding equipment. You can also top up the cover for baggage loss if you’re taking your laptop, tablet or netbook on your trip. It even has a home contents cover, which protects your home while you’re away.

Policy #4 FWD Travel Insurance

Standout features FWD policies offer an automatic travel cover extension. For the premium policy, you will get an automatic insurance cover extension of seven days. For enhanced cover policies, extensions of up to 21 days are granted. Also, it offers unique add-on riders including pet care, car rental excess and sports equipment protector.

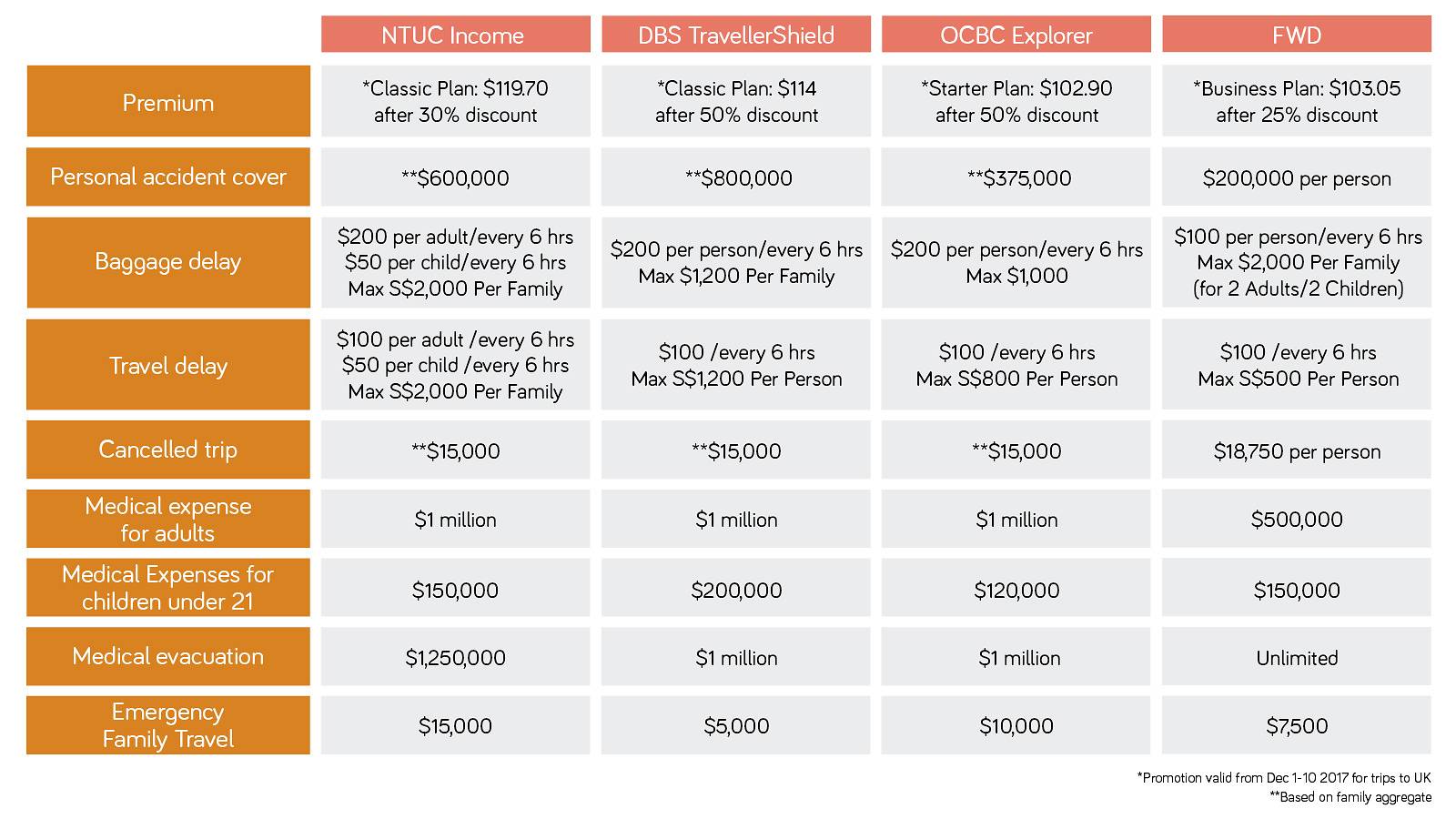

Check out this chart, which illustrates what your basic insurance cover will look like for a 10-day trip for you and your family in December, based on a trip to the UK. By the way, do remember that travel insurance rates are based on travel destination, as well as the duration of the trip.

This article was written by BankBazaar Singapore, a leading online marketplace in Singapore that helps consumers compare and apply for the best offers across all financial products: credit cards, personal loans, home loans, car loans & investments.

Photos: iStock

Like us on Facebook and check SmartParents regularly for the latest reads!

In case you missed these…

10 travel hacks to survive long-haul-flights with your tot